ePayAlert Risk Profile ControlsTo evaluate whether online payment transactions are fraudulent or legitimate takes a lot of time and effort to be manually reviewed. Therefore, it is necessary to streamline the process with the aid of a comprehensive fraud monitoring and prevention system that is capable of analyzing multiple parameters, process it, and conclude whether a credit card transaction is legitimate or fraudulent. Below are the different risk parameters ePayAlert uses to assess the risk of transactions online and in real-time.

Parameter Format Checking

Parameter Format Checking is used to determine the authenticity of the order based on the information provided by the customer such as credit card information, email address, and contact number. Credit card numbers are checked to determine if the credit card is expired or not. Free email addresses have a higher chance of being fraudulent than a paid or office email address. Contact numbers are cross-referenced to check if it is in the same country as the billing address.

Blacklist Control

ePayAlert maintains a blacklist database of credit cards that are automatically rejected by the system when they make a payment transaction. These cards are blacklisted due to various reasons such as the card was reported as stolen, previously used for fraud, or originating from a high risk country. Clients are free to add their own entries should they wish to do so. Analyzed information are:

- IP address

- Email

- Card Number

Geographical Checking

ePayAlert gathers system information from the customer’s computer such as IP address, country, language settings, and time zone and compare it with the order information such as billing and shipping address in order to assess the transaction using:

- High Risk Country Control – system will consider a transaction as risky if it came from a high risk country

- Country Mismatch Checking – system will consider a transaction as risky if the billing and delivery address is different

- Language and IP Checking – system will consider a transaction as risky if the language settings of the computer is incongruent with the location of the IP address

- Time Zone and IP Checking - system will consider a transaction as risky if the time settings of the computer is incongruent with the location of the IP address

Velocity Checking

Velocity checks are used to protect merchants and minimize fraud by enabling them to set transaction frequency limits and card usage within a specific timeframe. These features enable merchants to be alerted when there are possible instances of fraud due to abnormal buying behaviors such as:

- Buying 10 times using the same card in the span of 30 minutes

- Multiple order using different cards but shipped to the same address

- Multiple orders using different cards, names, and addresses but all from the same IP address

- Frequency of orders coming from the same URL

Transaction Limit Checking

Similar to Velocity Checking, Transaction Limit focuses more on the transaction frequency and amount. Transaction limit checking helps prevent the possible scenario of a fraudster ordering multiple items of a high-priced item.

Historical Negative Record Checking

Each time an online payment transaction is made, the result of each payment transaction is stored in a database for future reference. Cards that are found to be fraudulent are stored so the next time that card was used, it will be flagged for further review. Aside from the results of the transaction, cards with excessive chargebacks are also considered high-risk transactions as they may have been cases of friendly fraud.

Risk Scoring

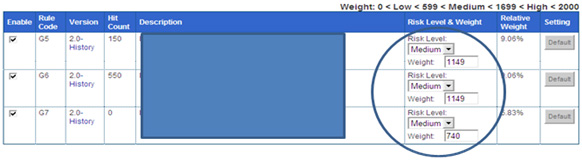

Businesses have different needs and operates under different circumstances and each has unique experience with online fraud. To help businesses, one of ePayAlert’s key features is its Risk Scoring that enables merchants to set their threshold for risk levels.

Furthermore, merchants can also determine the weight of each parameter and give a heavier weight for risk parameters that has more impact on their industry. This enables merchants to optimize the performance of ePayAlert in detecting fraud.

Customizable Rules

Upon request, ePayAlert can also develop customized specific rules that merchants may require in order to better protect their business from fraudulent transactions. |