|

How ePayAlert Works |

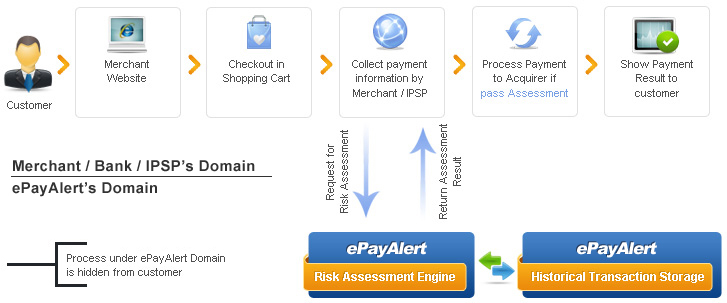

- The transaction process starts when a customer decides to buy a product from a merchant website.

- The customer then provides his credit card payment information.

- The system requests risk assessment from ePayAlert engine. The assessment engine checks for different variables such as IP Geolocation, Velocity Checking, and Negative Historical Record of transactions used with the credit card information submitted by the customer.

- If the credit card payment transaction is a success, it will then be processed by the acquiring bank and the customer will be directed to the payment confirmation page.

- If the assessment engine flags it as a high risk transaction, depending on the settings, it will be either be flagged for further review or rejected automatically. It will reflect on the online reporting tool and alerts will be sent via email and SMS to the risk management team.

- Upon completion of assessment of the transaction, whether the transaction suceeds or fails, the system will store the result and will be used as reference for future transactions. This will serve as a database for Negative Historical Record.

- All the processes and assessment is invisible to the customer and only takes a few seconds.

|

|

|